The silicon metal market in September 2023

Review of Silicon Metal Market

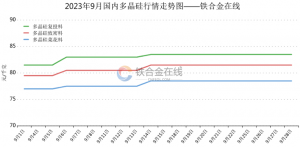

1)Price trend

Affected by the rising prices of oxygen-permeable low-grade products, aluminum alloy factories have increased their purchases of oxygen-impermeable 553# and 97 silicon. After part of the Oxygen 553# factory was converted to Oxygen production, the market supply was limited. The factory actively raised prices, and the price increase once exceeded that of Oxygen products. Oxygen low-grade products such as Oxygen 553#, 551#, and 99# silicon are in strong demand from polysilicon plants. As a result, prices have risen rapidly, and low-grade shipments from major manufacturers account for a large proportion. Price hikes have a greater impact on market price changes. Currently, products with low PB are 300-600 yuan more expensive than products of the same brand with high PB. The market transactions of chemical grade metal silicon such as 421# and 411# are active. After the market price of organic silicon rises, some factories plan to increase production. 3303#, 331# and other products are in short supply in the market, and prices are rising significantly. The output of 2202# and 2502# is not large, and the transactions of the factories under production are stable. The prices are rising but the frequency of changes is low.

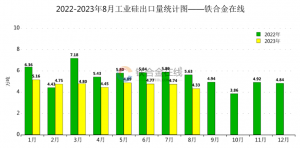

2)The Export Market of Silicon Metal

In August,the total export volume of silicon metal products was 43,317 tons, a year-on-year decrease of 12,941 tons, a decrease of 23%, and a month-on-month decrease of 4,112 tons, a decrease of 8.67%. The total export volume from January to August was 378,993 tons, a year-on-year decrease of 86,456 tons, or 18.57%.

The domestic silicon metal exports were even lighter in September. The export traders received few orders. Competition pressure in overseas markets is high, and domestic market demand is increasing. Industrial silicon exports may continue to maintain a slow downward trend in the future.

The Operating Rate of Silicon Factory and Areas

| Area | The total numbers of furnaces | The numbers of furnaces opened | Operating rate | Production capacity | Capacity release rate | Monthly output |

| Xinjiang | 210 | 131 | 62.38% | 148,500 | 57.45% | 126,700 |

| Yunnan | 138 | 117 | 84.78% | 102,200 | 85.24% | 93,660 |

| Sichuan | 111 | 88 | 79.28% | 67,880 | 73.34% | 60,200 |

| Fujian | 24 | 8 | 33.33% | 8,450 | 39.97% | 5,880 |

| Guizhou | 14 | 3 | 21.43% | 2,000 | 14.81% | 1,340 |

| Hunan | 21 | 0 | 0.00% | 0 | 0.00% | 0 |

| Inner Mongolia | 36 | 30 | 83.33% | 30,700 | 80.68% | 27,690 |

| Gansu, Qinghai, Shaanxi | 43 | 31 | 72.09% | 33,750 | 73.74% | 26,180 |

| Guangxi, Henan, Hubei, Ningxia | 23 | 12 | 52.17% | 11,900 | 62.80% | 9,540 |

| Chongqing | 20 | 7 | 35.00% | 6,020 | 50.80% | 3,690 |

| Dongbei | 30 | 14 | 46.67% | 11,450 | 52.89% | 9,610 |

| Total | 670 | 441 | 65.82% | 422,850 | 64.35% | 364,490 |

In September, 441 silicon furnaces were put into production, an increase of 56 units month-on-month and 19 units year-on-year. The operating rate was 65.82%, a month-on-month increase of 7.93%.The production capacity was 422,850 tons, and the capacity release rate was 64.35%, a month-on-month increase of 6.57%. The output was approximately 364,490 tons, a month-on-month increase of 38,170 tons, an increase of 11.70%, and a year-on-year increase of 37,040 tons, an increase of 11.31%. The cumulative output this year was 2,718,590 tons, a year-on-year increase of 172,750 tons, an increase of 6.79%.

In September, two large factories in Xinjiang increased production slowly, while small factories actively resumed production. Most factories maintained full production, and the total monthly output increased significantly. Silicon factories in Yunnan maintained stable operation at a high level, and output was stable. The silicon factories in Sichuan started operating at a stable high level at the end of August. More production was resumed in September, with monthly output increasing significantly, silicon factory production in Inner Mongolia was stable, and individual new factories were put into operation or planned to be put into operation. Entering October, based on the current market price, some silicon plants in areas with high electricity prices in Guizhou, Hunan and other places plan to resume production, and individual new projects in Inner Mongolia and Xinjiang are planned to be put into production. It is expected that industrial silicon output will continue to increase slightly by about 20,000 tons in October.

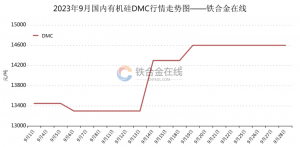

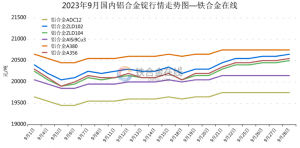

The Downstream Market

This month, polycrystalline silicon plants launched normal biddings to purchase metallic silicon powder, which has a great supporting effect on the rise of the industrial silicon market. Some of new polysilicon projects are about to be put into production, and production capacity will be increased slightly. The organic silicon market experienced a surge, but there was a slight correction at the end of the month. The implementation of the single plant’s production increase plan was not obvious.The factory operating rate remained within 70%. Aluminum alloy plants are operating normally, and monthly industrial silicon consumption is stable, but procurement enthusiasm is not high, and major manufacturers are replenishing stocks as needed.

The Market Prediction For October

Cost side: Petroleum coke, washed coal, and electrodes have all shown an upward trend recently. The flood season in Sichuan and Yunnan has only one month left. Production costs increased slightly in October, and silicon plants are highly motivated to raise prices.

Supply and demand side: Judging from the output and consumption in the past two years, the industrial silicon market is still in surplus, and the inventory is large. However, as the supply of futures delivery warehouses increases, there is not much supply in the spot market, and the low PB products required by downstream are in slight shortage due to the poor quality of raw materials such as silica and washed coal. This situation cannot be alleviated in October.

So the industrial silicon smelting costs show a slight upward trend, and there is still strong demand for low-grade oxygenated products despite stable polysilicon market consumption. It is expected that mainstream prices in the industrial silicon market will rise steadily in October.

The Silicon Metal Market In June 2025

I.Price trend of silicon metal Demand increased, and prices fell and then rose small. ......

The silicon metal market in May 2025

I. Raw Material Market Overview In May, raw material prices for silicon generally stabilize......

The silicon metal market in March 2025

1.Price Trends In March, the price of silicon metal continued to decline, leading to weak p......

The yearly report for silicon metal in 2024

I. 2024 Silicon Metal Price Trend Review 1. First Quarter: • Silicon prices kept falling. Be......

The silicon metal market in November 2024

Price Trend Silicon metal prices remained generally stable in November. Price rebound depen......